Our areas of expertise:

NPL:

Buying non-performing loans (NPLs) is a great way to invest in real estate. NPLs can be purchased starting at 20% of the nominal value.

This discount offers significant flexibility to "work out" the note with the borrower, creating a win-win situation for the owner and the investor. Our strategies evaluate each option to achieve above-average returns and maximize the value of the investment.

FINTECH:

Fintech companies are innovating across broad categories—banking, lending, insurance, real estate, and investing—on both the customer and core infrastructure sides. We believe the combination of mobile, digital money, machine learning, and new data sources offers startups a unique opportunity to leapfrog outdated infrastructure and compete with incumbent financial institutions to reinvent the way we manage our finances.

REAL ESTATE:

We believe in a future-oriented urbanism, capable of improving the quality of life and responding to the needs of an evolving society. We invest in modern infrastructures, designed to be points of reference for the community and to promote harmonious and sustainable urban development.

We create living and commercial spaces that combine design, functionality and energy efficiency, contributing to the growth of cities and the well-being of people.

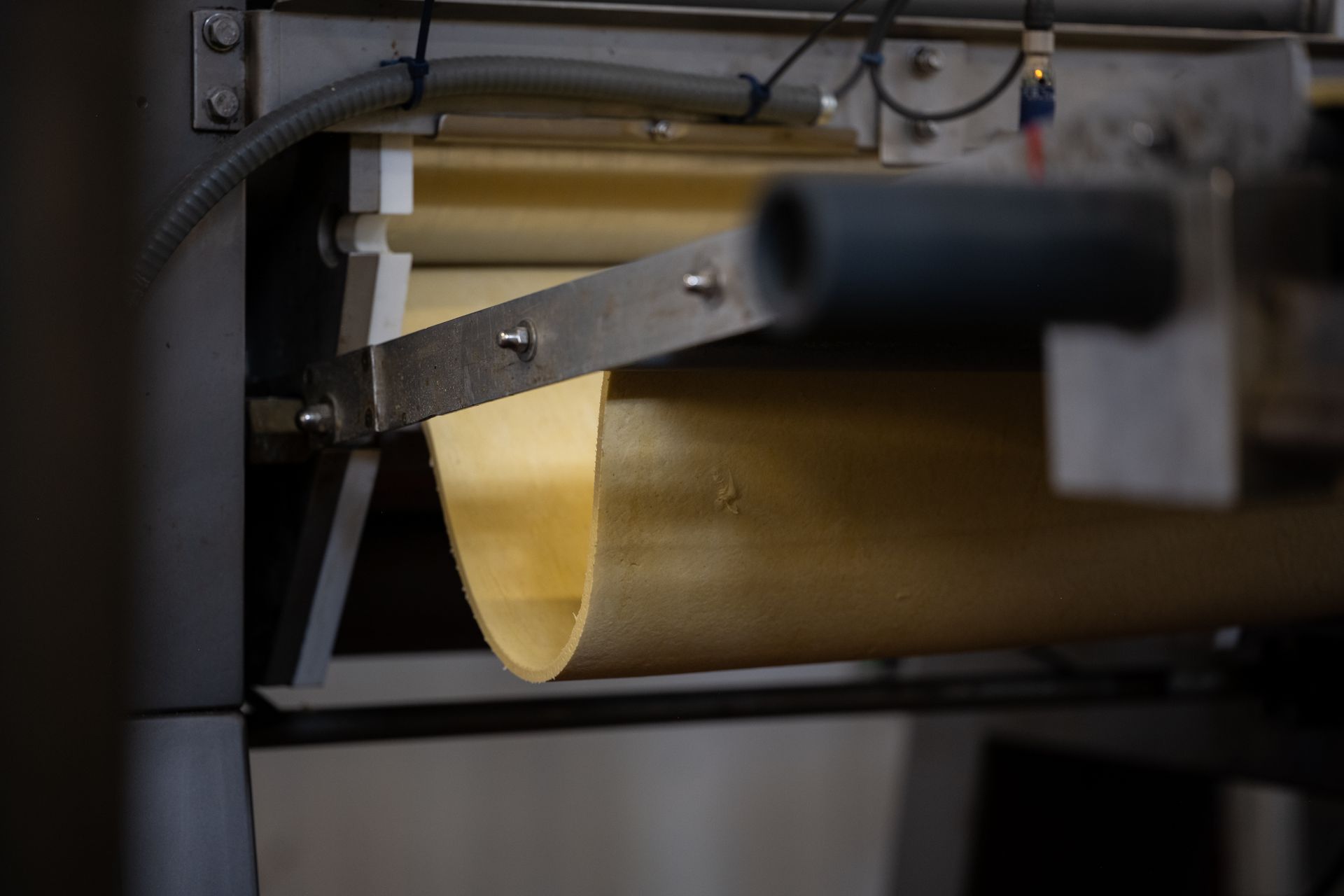

FOOD:

Thanks to leading companies such as SAISpA and IPASrl, we guarantee high standards in food production, enhancing Made in Italy. Our mission is to bring Italian food and wine excellence to the world, combining tradition and innovation. We invest in research and development, with cutting-edge processes that respect safety and sustainability. With an international network, we expand the presence of our products, strengthening Italy's reputation in the agri-food sector.

LOGISTICS:

In the logistics sector we operate through Crown Asset & Investment Sro, a company specializing in asset management and advanced logistics solutions. Our goal is to ensure operational efficiency and international competitiveness, supporting companies in different sectors in optimizing resources. Thanks to cutting-edge technologies we implement advanced traceability, process automation and supply chain strategies to improve the speed, reliability and sustainability of logistics operations.

DEBT RESTRUCTURING:

Melion Capital specializes in debt restructuring through the acquisition of companies in distress, with the aim of relaunching their business and creating new value. Through a strategic approach, we negotiate with creditors to optimize the financial structure, implement recovery plans and promote sustainable growth. Our experience allows us to transform companies in difficulty into solid and competitive entities on the market.